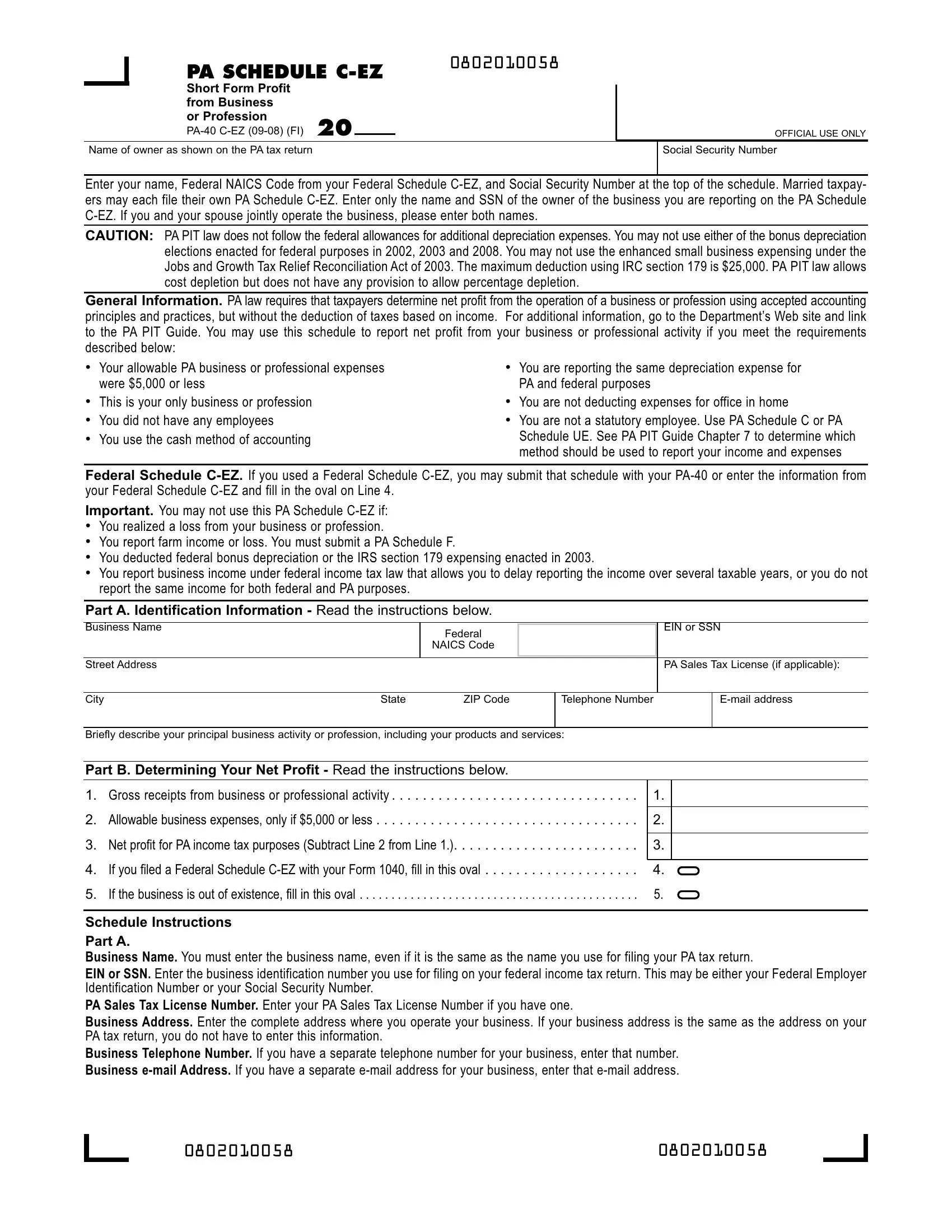

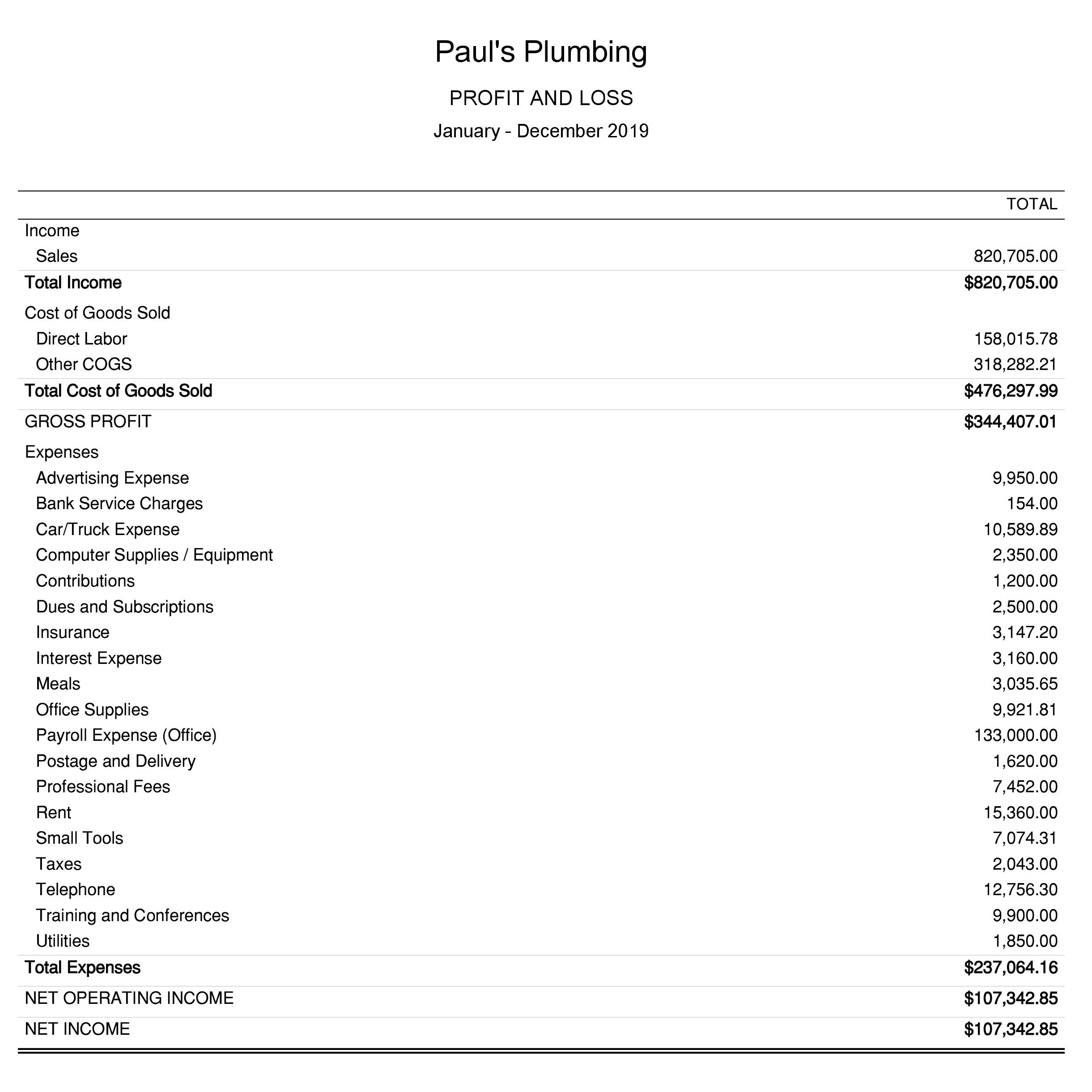

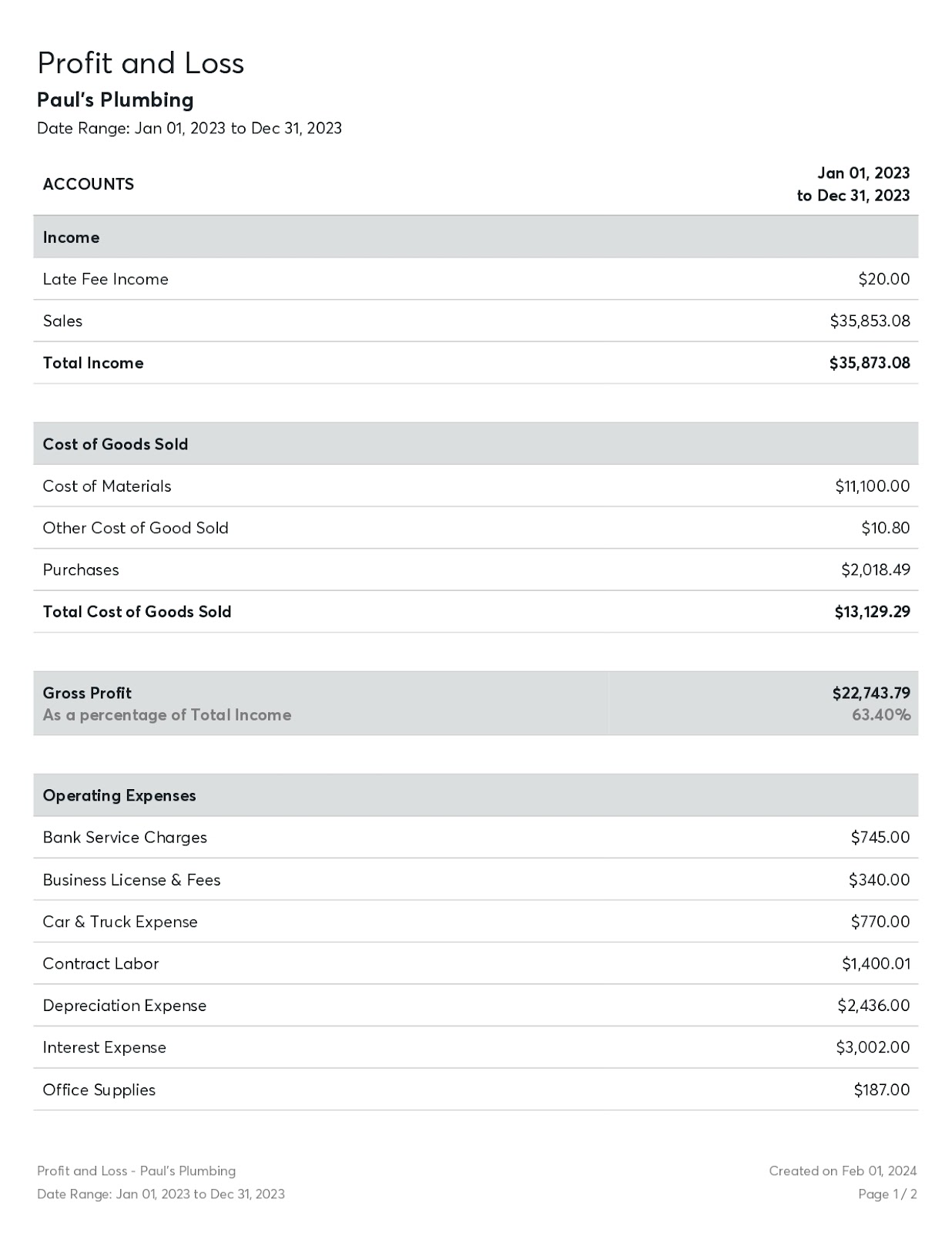

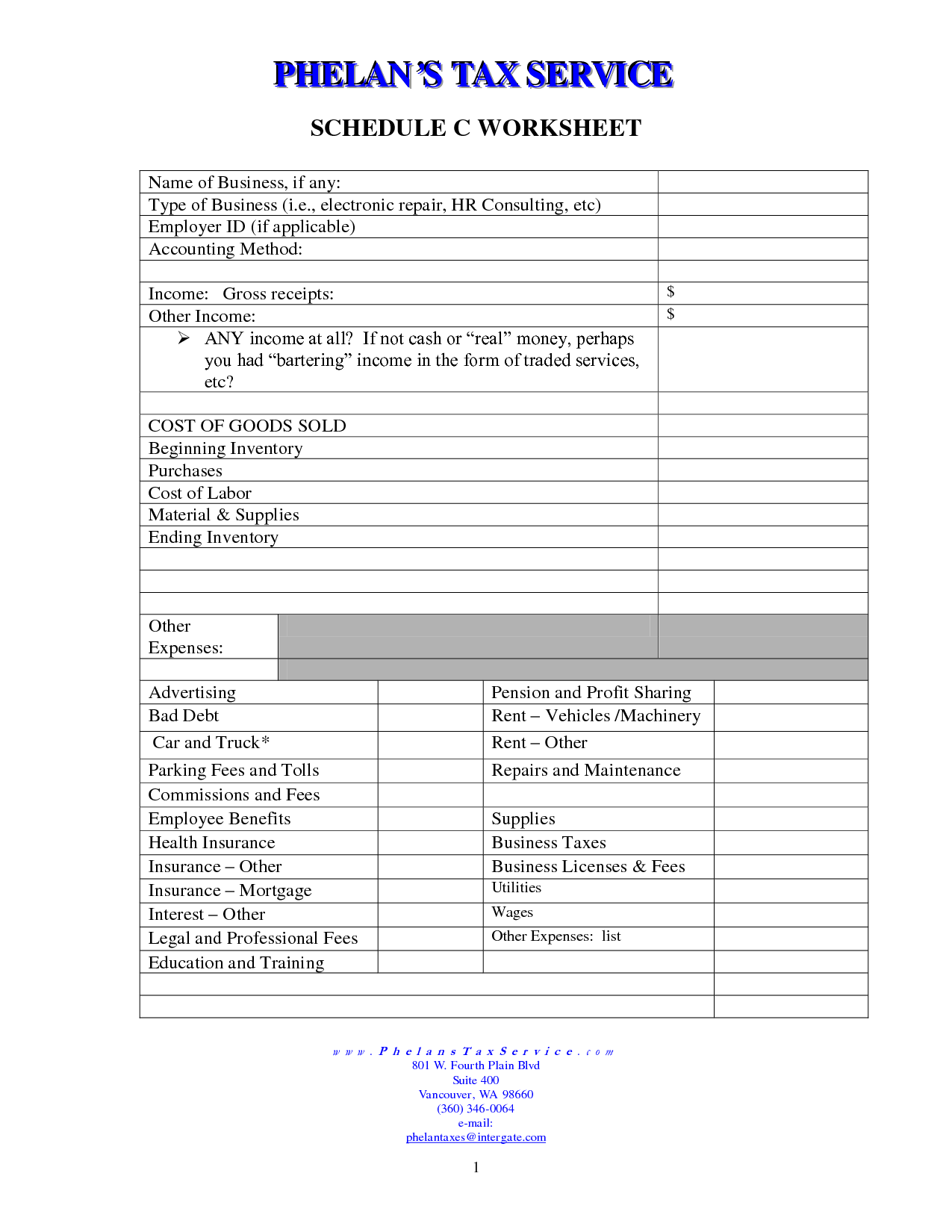

Websep 19, 2022 · schedule c is the linchpin of your independent contractor taxes. It's the form that lets you claim business expenses regardless of whether you itemize your tax. Webfilling out schedule c for your doordash business is a relatively straightforward process. Here are the key sections and questions you need to pay attention to: Webfilling out a schedule c is one of the most effective ways for doordash contractors to pay only what they owe in taxes. Documenting their business income and expenses ensures. If you want to deduct expenses related to your income then you will need. Webuse schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your.

Related Posts

Recent Post

- Missoulian Death Notices

- Leslie Ave

- R Berserk

- 48 News Huntsville Alabama

- Koat Anchors Leaving

- C8 Body Material

- Modesto Raid

- Missoulian Obituary Notices

- Shooting In Lancaster Last Night

- Lennar Homes Sales

- In Need Of A Job Asap

- Best Custom Glock Companies

- Autonation Nationwide Search

- Deca Dental Jobs

- Realtor Ridgeland Sc

Trending Keywords

Recent Search

- Non Truck Driving Jobs

- What Did Chris Hansen Get Arrested For

- 3 Hours Part Time Jobs Near Me

- Upper Darby Pa News

- Where Are Bowl And Basket Products Made

- Timber Company Hunting Leases In Tennessee

- Phoenix 40up

- Subcontractor Work Near Me

- Physics 1201 Osu

- Katelyn Heling

- Portable Suction Dredge Pump System

- Bachelor Party Gif

- Ferguson Toilet Bowl

- Wiaa Football Rankings Washington

- Portland Maine Police Arrest Log

/GettyImages-174038203-5a4d1e6de258f80036c28e70.jpg)

:max_bytes(150000):strip_icc()/ScheduleD2022IRS-11353a1e824e41a9a83f83e39fd0f879.jpg)

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)